Last month, a new hospital price study by RAND Corporation revealed that depending on which side of the Ohio River they live, individuals with private insurance who receive hospital services pay more to Hoosier hospitals than to those in the Bluegrass State. On June 4, the Kentuckiana Health Collaborative brought together key healthcare stakeholders to explore the study that continues to make national headlines, from the New York Times to Modern Healthcare.

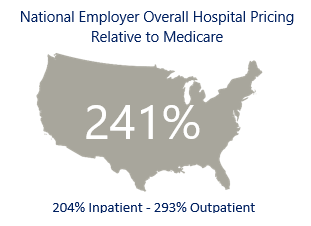

Gloria Sachdev, PharmD, President and CEO of the Employers’ Forum of Indiana and leader of the study, kicked off the KHC Community Health Forum by describing the study. She explained that employers in her coalition told her that hospital pricing, which accounts for one-third of healthcare spending in the U.S., was higher in Indiana than other locations in the U.S. She set out to find answers to their questions and partnered with RAND for a study to look at Indiana commercial hospital pricing relative to Medicare pricing. The results were startling, with outpatient pricing at 358% of Medicare prices for the same services. Indiana hospitals claimed that their pricing was normal for commercial insurance rates, so a second study was conducted comparing pricing nationally. The National Hospital Price Transparency Report, released in May, showed that Indiana’s hospital pricing was not normal as the hospitals claimed. The results of the 25 states that participated showed that on average, employers pay 241% of what Medicare would pay nationally. Indiana topped the nation at 311% of Medicare pricing. The study nationally showed prices rising and wide variation in pricing with some hospitals charging private insurance 500% of what Medicare would have paid.

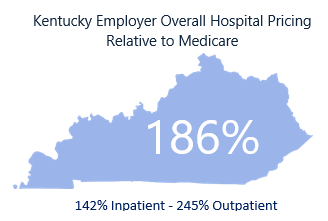

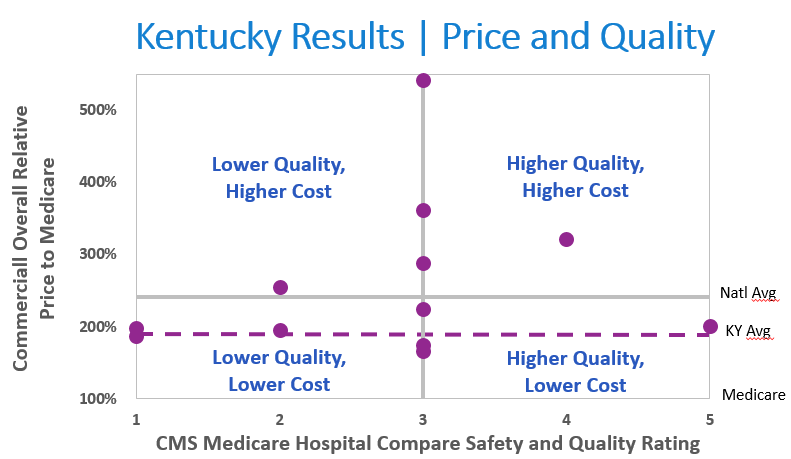

Stephanie Clouser, KHC Data Scientist, presented Kentucky’s results which looked favorably for pricing. Kentucky ranked fourth lowest of the states in the study, with an overall hospital price of 186% of Medicare pricing. In addition to below-average hospital pricing, Kentucky’s prices moved sharply downward over the three years of the study. However, Kentucky’s results showed wide variation between outpatient and inpatient pricing at 245% and 142%, respectively. Both Kentuckiana (including Southern Indiana) and Kentucky had among the worst hospital quality and safety ratings of all the regions and states in the study. Clouser explained the goal is for employers to find the hospitals in Kentucky with high value, meaning they have both high quality and best pricing. One of the big questions that came out of this study was to determine what is reasonable pricing for commercial insurance to pay above Medicare, and this answer will determine which hospitals are considered “high value.” For now, no Kentucky hospitals would be considered “high value” using Kentucky’s overall relative pricing of 186%, but there is one hospital that would be considered “high value” using the national average of 241% (see graph below).

How are employers responding to this data? Christan Royer, M.Ed., Director of Benefits, Human Resources, Indiana University (IU) and Chairman of the Employers’ Forum of Indiana, told event attendees how her organizations is responding to their increasing healthcare and hospital costs. She indicated that increasing costs have affected their ability to give salary increases to employees. With their healthcare costs averaging 7% increases each year over the last four years and salary increases averaging 2% each year, healthcare costs continue to outpace employee pay and inflation year after year. Christan explained that employers can no longer keep raising premiums and deductibles or using Health Savings Accounts (HSAs) as they have always done in order to bend the cost curve. Employers will need to explore new levers to solve increasing costs, such as contracting for Medicare plus costs, direct contracting, or tiered networking. Currently, Employers’ Forum of Indiana is convening employers to explore these new ways of addressing unsustainable healthcare costs for employers. In 2018, family premiums for commercial insurance averaged nearly $20,000 per year in the U.S.

These findings turned on the light for many employers who generally operate in the dark around hospital pricing yet are responsible for purchasing healthcare for more than half (55%) of all Americans. The study showed wide variation in quality and cost among hospitals and states and illuminated that costs are often not a predictor of the quality and safety of care employees and families receive.

At the KHC, we bring together hospitals, providers, policymakers, plans, consumers, and employers to improve health status and healthcare delivery in the Louisville area and throughout the Commonwealth of Kentucky. The KHC has focused much of its efforts on working to improve primary care quality, transparency, and measurement alignment but has given little attention to hospital quality or pricing. We know that our hospital systems are committed to driving improvements to patient health and safety, but we have work to do to achieve the quality ratings of other states and communities. We are forming a new workgroup to discuss how we can collectively drive improvements to hospital value in our region. Hospitals, health plans, and employers are invited to join this workgroup.

The KHC is one of many National Alliance of Healthcare Purchaser Coalitions members participating in the study and is currently recruiting employers and health plans for the next iteration of the National Hospital Price Transparency Report, scheduled for release in January 2020. An information sheet is available for Kentucky employers along with a webpage for how to get involved. A national informational webinar for employers is scheduled for July 9.

To learn more about getting involved, email info@khcollaborative.org.